- Mountain Home School District #193

- Supplemental Levy

Business & Finance

Page Navigation

-

Your Participation Matters

Posted by:We encourage all community members to mark their calendars for November 4 and consider voting to make their voices heard. Every vote counts!

-

What Is A Supplemental Levy?

Posted by:A supplemental levy is a voter-approved county tax. The money gathered from this levy is allowed to pay for the continued maintenance and operations of schools as allowed by Idaho Code 33-802. These maintenance and operations include any general fund expenditures. These expenditures can include staffing, salary and benefits, student activities and programs, safety and security measures, curriculum, transportation, and special services.

-

What does the Levy Fund?

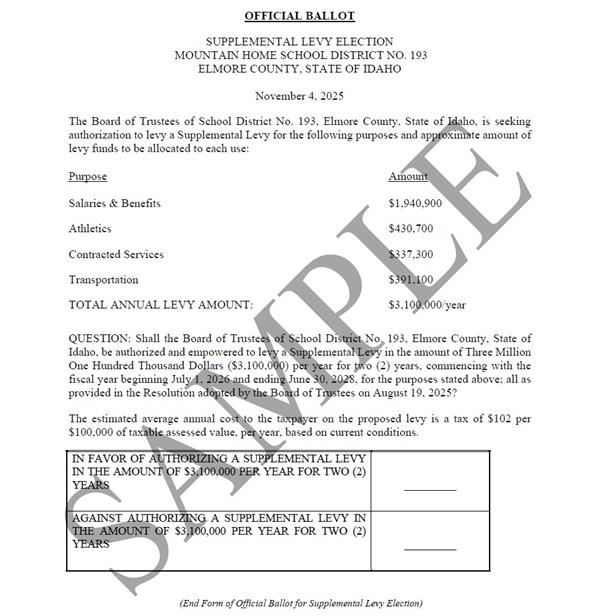

Posted by:Idaho Code directs school districts to include on their ballots how the levy is going to be used.

On the ballot in November, you will find a measure directly impacting the quality of education within our district. It's crucial to understand that this levy is aimed at sustaining essential support for our educational programs at their current level.

-

Salaries and benefits for staff — $1,940,900

-

Contracted Services for student needs — $337,300

-

Student Athletics funding — $430,700

-

Student transportation — $391,100

-

-

What does the Levy cost the Taxpayers?

Posted by:The estimated average annual cost to the taxpayer on the proposed levy is a tax of $102 per $100,000 of taxable assessed value, per year, based on current conditions. The levy will be assessed for two (2) years.

The Idaho Schools Facility Fund will offset this amount to the taxpayers if the levy passes. The School Facilities Fund currently offsets the entire Supplemental Levy to the county. We anticipate the same in the coming years.

-

What Happens If The Supplemental Levy Does Not Pass?

Posted by:If the levy does not pass, the district will construct a budget based on the lost revenue. This budget will include cuts to staffing, salary, benefits, student activities, student programs, student transportation, and special education services.

-

Why Are We Voting For The Supplemental Levy In November?

Posted by:Running the supplemental levy in November allows the school district to properly create a budget. Budgets are planned in April, and set in May, and will be implemented on July 1 for the upcoming school year.

-

Are Supplemental Levys Common In Idaho School Districts?

Posted by:Yes. Currently, 77 out of 115 school districts have supplemental levies.